Post-event sponsor survey questions

What do you want to know about your exhibitors and sponsors?

Typically, event organizers want to understand how satisfied they were with the event, if they will exhibit or sponsor in the future, and what would make the event unmissable?

We are going to share with you our ultimate list of post-event sponsor and exhibitor survey questions.

12 key questions to ask exhibitors and sponsors in your post-event survey

- Which of the following were objectives for your company at [eventname]?

- Please state how well you met each of your objectives for exhibiting/sponsoring.

- Overall, how well did you meet your objectives for exhibiting/sponsoring at the event?

- How satisfied were you with the following aspects of the event?

- What was the total value of the orders/purchases/contracts received by your company at the event?

- INCLUDING sales you have already made, what is the total value of the sales you expect to generate over the next 12 months as a result of exhibiting at/sponsoring the event this year?

- Considering the total sum of business you expect to generate as a result of exhibiting at [eventname] this year, how would you rate your overall return on investment?

- Overall, how satisfied were you with [eventname] this year?

- How likely are you to exhibit/sponsor [eventname] next year?

- How likely are you to recommend [eventname] to a friend or colleague in the industry?

- Please tell us why you gave that score. i.e. recommending the event to a friend or colleague

- How would you improve [eventname]?

Examining Customer Objectives

1. Which of the following were objectives for your company at [eventname]?

The most common objectives for exhibitors and sponsors are to generate new sales leads, increase awareness for their product/service and/or increase their brand position. Monitoring what objectives your exhibitors are trying to achieve through your event can be useful information when designing your event.

2. Please state how well you met each of your objectives for exhibiting/sponsoring.

Allow exhibitors and sponsors to state how well they were able to meet each of the objectives they selected. This will give you an indication of what objectives you’re helping them achieve versus the objectives that are going unmet.

3. Overall, how well did you meet your objectives for exhibiting/sponsoring at the event?

Not all objectives are created equal. This is why getting an overall score is important. Earlier in the survey, exhibitors and sponsors may select five different objectives and only score one as being well met. But that one could have represented their main objective for attending the event whilst the others were ‘nice to haves’. This question will give you an overall view of how successful your event is at helping attendees achieve their objectives. Alternatively, with the Explori survey tool, this can be calculated automatically based on the previous question responses.

Identifying highlights and pain points

4. How satisfied were you with the following aspects of the event?

With this question, you can gauge your customer’s satisfaction with different aspects of your event. In particular, options we think are useful to include are:

- Quality of visitors

- Quantity of visitors

- Quality of sessions

- Networking

Assessing the value of your event

5. What was the total value of the orders/purchases/contracts received by your company at the event?

Where relevant, include this question to encourage exhibitors to consider the monetary value of participating in your event. This can also serve as a marketing metric to use to promote your next event.

6. INCLUDING sales you have already made, what is the total value of the sales you expect to generate over the next 12 months as a result of exhibiting/sponsoring the event this year?

There are some events where exhibitors and sponsors do not complete transactions on their stand. In this instance, it can be helpful to understand how they expect their participation in the event to convert into sales over the next 12 months.

Measuring ROI and Importance

7. Considering the total sum of business you expect to generate as a result of exhibiting at [eventname] this year, how would you rate your overall return on investment?

Return on Investment is one of the most important metrics to track for your event. Our global research shows that an unclear return on investment is the biggest driver of exhibitor dissatisfaction. Difficulty demonstrating ROI is the most frequently given reason for low advocacy scores. This question is a great temperature check to identify what proportion of your audience is struggling with the return so that you can intervene with relevant training and educational materials ahead of your next event.

Evaluating overall exhibitor and sponsor sentiment

8. Overall, how satisfied were you with [eventname] this year?

This question allows you to directly measure customer satisfaction and get a more bird’s eye view of how the event went overall. Use it to discover which exhibitor/sponsor types are most satisfied. This is a great way to gauge the success of your event.

9. How likely are you to exhibit/sponsor [eventname] next year?

Ask exhibitors and sponsors this question to predict the environment your team will be selling into. Are your customers saying they are unlikely to return and are therefore disengaged? This will mean the team will have to work harder to get new customers through the door. However, if there is a larger proportion who are planning to return the following year this can be a good signal of engagement. Your team probably won’t have to work as hard to get them through the door.

10. How likely are you to recommend [eventname] to a friend or colleague in the industry?

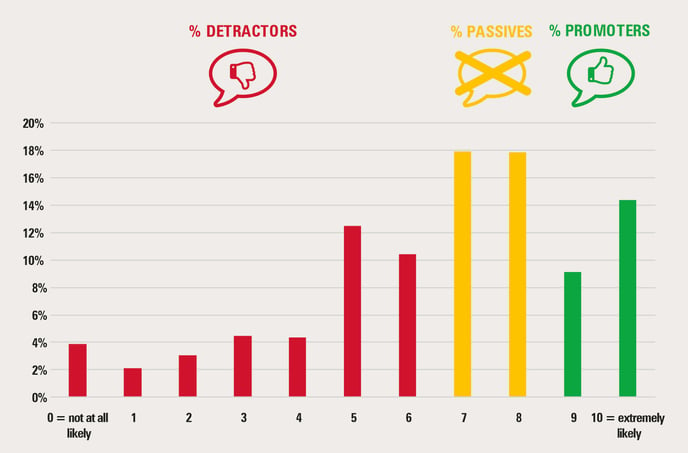

Net Promoter Score is an industry-standard when it comes to measuring attendee experience. It allows you to measure your attendees’ likelihood to recommend your event and can be included in your post-event surveys for both virtual and live events. Respondents rate their likelihood to recommend on a scale of 0-10 and are banded into groups based on their scores.

- Promoters (9-10 rating)

- Passives (7-8 rating)

- Detractors (0-6 rating)

The Net Promoter Score is then calculated by subtracting your percentage of Detractors from your percentage of Promoters.

Organizers often ask what is a good Net Promoter Score. Technically speaking, anything above zero means you have more Promoters than Detractors and is, therefore, a good score. The Explori platform benchmarks NPS for live and virtual events globally. This allows clients to compare the performance of their events against the industry standard and get a real sense of how their events compare to the industry benchmark.

11. Please tell us why you gave that score? i.e. recommending the event to a friend or colleague

Open questions are a great way to collect qualitative data that can be used to explain scores. We always suggest adding an NPS reasoning question. It allows you to do some meaningful analysis of your detractors and promoters. For example, in the Explori platform, clients can filter by NPS to see all the responses given by detractors or promoters. Filtering in this way can give you a sense of why some attendees are detracting and why some are promoting.

12. How would you improve [eventname]?

Including a question about improvements is an easy way to spot what aspects of your event haven’t landed well with attendees. Depending on the tool you use, you can filter based on satisfaction or NPS to see what improvements are suggested by attendees.

Survey your exhibitors and sponsors with Explori

The Explori feedback platform offers all of the above questions are templated to save you time creating your own. Our platform collates responses and presents them using responsive dashboards. Your event dashboard shows you your Overall Event Score as well as KPIs, including Net Promoter Score, Overall Satisfaction, Loyalty, and more. With the click of a button, you can compare the metrics for your event with industry benchmarks as well as your own company benchmarks.