11 Most Important Post-Event Survey Questions For Attendees

How do you know if your event is a success? Better yet, how do you know if your attendees will return next year?

The explosion in event technology means organizers have more data than ever about how attendees engage with events, from the number of meetings booked to sessions attended and questions asked. However, this data isn’t enough to tell you why. Why are attendees engaging, and will they return to your next event? This is where surveys come into play.

Explori has been helping organizers use surveys to gather post-event feedback for the last decade to develop more customer-centric event portfolios. We benchmark attendee experience for over 3,000 events globally and analyze over 3 million data points on attendee and exhibitor sentiment. We are a trusted research partner for the Global Association for the Exhibition Industry (UFI), supplying annual reports to organizers. Our expertise lies in creating surveys that provide strategic insights to event teams.

Here is our definitive list of post-event survey questions, equipping you with eleven questions for a live or virtual event survey.

What is a post-event survey?

A post-event survey is a questionnaire. It is normally distributed via email to visitors, exhibitors, speakers, people who registered but did not attend, and any other participants. The survey normally consists of multiple/single-choice and open-ended questions. The purpose of sending a post-event feedback survey is to understand the event through the attendees' eyes. Post-event surveys are crucial to any organizer adopting a more customer-centered event approach.

Types of survey questions

There are different types of questions you can include in your post-event survey depending on the type of data you want to collect:

- Rating scales - measure the level of agreement with a question that can be quantified for reporting. Using reporting values, a 5-point scale is best to avoid skewing survey responses.

- Multiple choice - useful when there are a few options that could apply, i.e., when asking attendees about their reasons for attending your event.

- Open-ended - brings the attendee experience to life. It produces qualitative data, which tends to be more emotive and specific at outlining sentiment.

Screening questions

At the beginning of your event survey, screening questions can ensure the integrity of the data you are collecting. When creating client surveys, the first question is, ‘Did you attend [eventname] from [eventdates]?’ If the respondent says no, they are routed to an exit screen.

We then include a second screening question which asks, ‘Did you attend as…’ and provide a single choice option of either Visitor, Exhibitor, or Member of the press. If the respondent is not the intended recipient of the survey (i.e., an exhibitor receives the visitor survey), they will be rerouted to an exit page with a link to the relevant survey for their group.

By including screening questions, you can ensure that the right audience is completing your survey.

General Survey Questions

Use these questions in both your live and virtual post-event surveys for attendees

1. Overall, how satisfied are you with [eventname]?

This question allows you to directly measure attendee satisfaction and get a more bird’s eye view of how the event went overall. This is a great way to gauge the success of your event. You can also use it to unpick which aspects of your event drive satisfaction by creating crosstabs with other questions in your survey.

2. What were your main reasons for attending [eventname]?

In other words, what is your event helping attendees do? Our studies show that the top five objectives of trade show visitors are attending the conference, attending seminar sessions, seeing new products and innovations, keeping up to date with market trends, and seeking new business partners. When using this multiple-choice question, include a list of common objectives and allow respondents to select more than one.

3. Please state how well you met your objectives at [eventname]?

Allow respondents to state how well they were able to meet each of the objectives they selected at your event. This will give you an indication of what objectives you’re helping attendees achieve versus the objectives that are going unmet.

For example, across the 3,000+ shows we have benchmarked, we found three common attendee objectives are poorly met at trade shows:

- Keeping up to date with market trends

- Seeking new business opportunities

- Seeing new products and innovations

Most importantly, we discovered that these three objectives are highly correlated with overall satisfaction. This suggests that if you improve the ability of attendees to achieve these objectives, you will see an increase in attendee satisfaction.

4. Overall, how well did you meet your objectives?

Not all objectives are created equal. This is why getting an overall score is important. Earlier in the survey, attendees may select five different objectives and only score one as being well met. But that one could have represented their main objective for attending the event whilst the others were ‘nice to haves’. This question will give you an overall view of how successful your event is at helping attendees achieve their objectives. Alternatively, with a tool like Explori, this can be calculated automatically based on the previous question responses.

5. How likely are you to recommend our event to friends or colleagues in the industry?

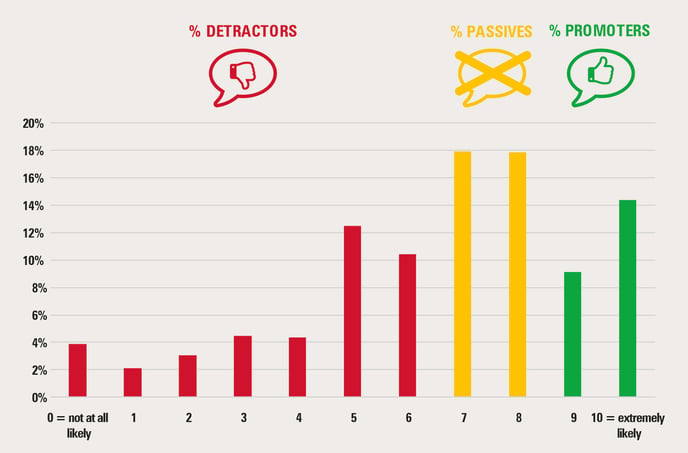

Net Promoter Score is an industry-standard when it comes to measuring attendee experience. This allows you to measure your attendees’ likelihood to recommend your event and can be included in your post-event surveys for virtual and live events. Respondents rate their likelihood to recommend on a scale of 0-10 and are grouped based on their scores.

- Promoters (9-10 rating)

- Passives (7-8 rating)

- Detractors (0-6 rating)

The Net Promoter Score is then calculated by subtracting your percentage of Detractors from your percentage of Promoters.

Organizers often ask what is a good Net Promoter Score. Technically speaking, anything above zero suggests you have more Promoters than Detractors and is a good score. The Explori platform benchmarks NPS for live and virtual events globally. This allows clients to compare the performance of their events against the industry standard and get a real sense of how their events compare to the industry benchmark.

6. Please tell us why you gave that score? i.e. recommending the event to a friend or colleague

Open questions are a great way to collect qualitative data that can be used to explain scores. We always suggest adding an NPS reasoning question. It allows you to do some meaningful analysis of your detractors and promoters. For example, in the Explori platform, clients can filter by NPS score to see all the responses given by detractors or promoters. Filtering this way can give you a sense of why some attendees are detracting, and some are promoting.

7. Considering the total investment of your time spent, how would you rate the value you received?

As event organizers, we are in the business of creating value for our attendees. Asking a question about their perceived value of the event is a great way to measure the usefulness of the event relative to the time cost. Including this question in your post-event survey will allow you to spot commonalities between attendees who rate virtual as better for time and those who do not.

8. What was your favorite aspect of [eventname]?

Gathering feedback mainly aims to understand how to improve your event. However, it is important to keep an eye on what is going well to ensure you don’t eliminate those aspects from future events (i.e. a networking format that attendees enjoy). This open-ended question can provide useful information about what works at your event. You may also be able to use these responses as testimonials if you ask respondents to opt in.

9. Do you have any suggestions on how the event could be improved?

Including a question about improvements is an easy way to spot what aspects of your event haven’t landed well with attendees. Depending on the tool you use, you can filter based on satisfaction or NPS to see what improvements are suggested by attendees.

10. How likely would you be to attend future events from the organizers of [eventname]?

This question provides a double benefit. On the one hand, it can communicate a level of satisfaction with the virtual event you organized, but it can also indicate whether or not your attendees are likely to attend future events.

11. Overall, how would you rate the delivery of the event?

Whilst you might still be finessing exactly how to deliver events that meet your attendees' objectives, this could be a great question to add to your post-event survey. Pair it with an open-ended follow-up question where respondents can explain why they gave it that rating.

Consistent feedback for strategic events

Organizations need to collect consistent feedback to create strategic events that keep their customers at the center. Post-event surveys are the only tools built to give organizers an insight into their attendees and exhibitors.